Introduction to Perps

Levana Well-funded Perps is a protocol for perpetual swaps, which are leveraged trading contracts. It aims to manage risk and provide benefits to both traders and liquidity providers.

For traders, Levana's solution is to make all positions "well-funded," meaning that the maximum profit for each position is locked in advance. This eliminates the possibility of bad debt and insolvency, providing greater security.

Liquidity providers, on the other hand, receive a yield for taking on the risk of market instability. They supply funds that act as collateral, and in return, they earn a fee with a risk premium.

The protocol addresses the issues with existing perpetual swap models, such as the virtual AMM. These models rely on complex mechanisms to maintain price stability, but they have limitations and can be risky in volatile markets.

By separating different trading pairs and creating a decentralized market for liquidity, Levana reduces the risk of contagion between different markets. This also makes it easier to expand to other blockchain networks.

Overall, Levana's perpetual swaps protocol offers a reliable and secure platform for traders and liquidity providers. It ensures fair settlement, minimizes risks, and allows for the development of additional financial protocols on top of tokenized positions.

Glossary of Terms

The following is a glossary of terms commonly used throughout the rest of the documentation. It pairs very well with the high level overview. If this is your first time reading about Levana Perps, some of the concepts below may not make sense on first read. Our recommendation for getting up to speed is to:

- Review this page, not getting hung up on concepts that don't make sense

- Go through the high level overview, referring back to this page to check definitions

- Review the slides

- Come back to this page; the terms should make much more sense at that point

- Base asset: the asset being speculated on. In a hypothetical ATOM/USD perps market, ATOM would be considered the base asset.

- Quote asset: the currency used for denoting the price of the base asset. We are speculating on the price shift between base and quote assets. In the ATOM/USD case, USD would be the quote asset.

- Collateral asset: the asset deposited into the perps system by both traders and liquidity providers. Due to the implementation of crypto-denominated pairs, this could be either the base or quote asset.

- Notional asset: the opposite of the collateral asset. In the ATOM/USD market, if ATOM is used as collateral, USD is the notional. The concept of notional asset is an internal implementation detail of the platform; traders will generally want to think in terms of base and quote. This is also explored in more detail in crypto-denominated pairs.

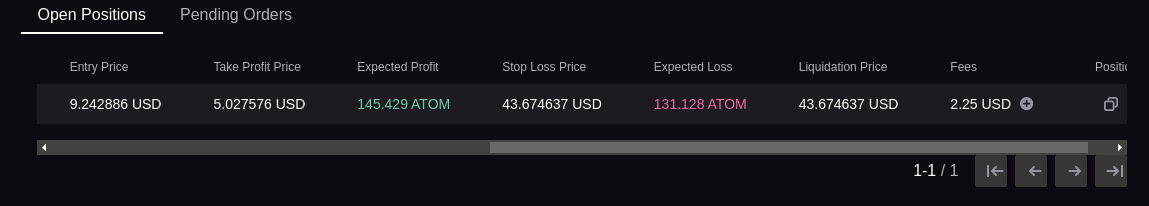

- Entry price: price of the asset at the time a position was opened. From a user perspective, price is always given in quote-per-base units (e.g. 10 USD per ATOM). Internally it will also be represented as notional-per-collateral.

- Deposit collateral: the total amount of collateral asset deposited by a trader to open a position.

- Counter collateral: the amount of collateral locked from the liquidity pool in a position.

- Max gains: the maximum amount of gains a trader can achieve on a position. Unlike other platforms, Levana perps’ well-funded guarantees rely on having locked maximum gains for a position.

- Note that max gains are not exposed in the UI, instead we use a take profit price for user convenience.

- Leverage: how much to leverage your collateral when opening a position. Positive leverage means taking a long position and negative means taking a short position.

- Notional size: the overall size of a position. This is the deposit collateral times leverage. It is stored in terms of the notional asset, and is converted to collateral using the entry price. Note that positive notional size is a long position and negative is a short position.

- Net notional: the sum of the notional size of all open positions. A positive net notional means that longs are more popular than shorts and therefore longs will pay a funding payment to shorts.

- Delta neutral: when the net notional in the protocol is 0, meaning an equivalent value of longs and shorts are open. We strive to keep the protocol delta neutral to protect liquidity providers from price exposure risk.

- Trading fee: fee paid by traders when opening or updating positions. This is split between the protocol and liquidity providers following the protocol tax config value. By default, 30% goes to the protocol, 70% goes to LPs.

- Delta neutrality fee: a fee paid when an action moves the protocol away from delta neutral, and received when an action moves the protocol towards delta neutral. For example, if longs are more popular than shorts, opening a long will incur paying out a fee, and opening a short will receive a payment from the delta neutrality fund.

- Borrow fee: fee paid by traders to liquidity providers for locking up liquidity. The fee is split between the protocol and LPs using the same protocol tax as the trading fee uses. This is an ongoing fee collected on a continuous basis as long as the position remains open.

- Active collateral: the amount of collateral available within a position. This will start off equivalent to deposit collateral minus fees paid at position open. However, as additional fees are paid and price movements are adjusted for, the active collateral will go up or down. Note that this will change the effective leverage of a position, since the notional size will remain fixed.

- Liquidation price: the price at which a position will be force-closed because it risks being insolvent and unable to pay additional fees. This can occur because the price has moved or because fees have depleted the active collateral.

- Take profit price: the price at which a position has achieved its maximum possible PnL by capturing all the counter collateral locked in the system. At this point, the position is force-closed and profits delivered to the user.

- Liquifunding: a process performed when positions are updated, closed, and on a regular basis to collect fees, adjust balances for price exposure, and determine new liquidation prices.

- Liquifunding delay: the time period of delay between a position being opened/updated/liquifunded and the next scheduled liquifunding.

- Staleness period: The time interval that a position can remain open after the completion of the liquifunding delay without risking illiquidity. If a position remains open past this period, the protocol is considered stale.

- Notional size in collateral (previously called notional value): This is the notional size of the position converted to the collateral asset at the current exchange rate.

- Liquidation margin: funds set aside within a position’s active collateral that can cover the maximum potential fees the position can occur until its next “staleness” point. If the position if not liquifunded before that staleness point, the entire protocol becomes stale since we cannot guarantee well fundedness.

- Position size: exposure to the base asset of the position.

- Carry leverage: the amount of leverage we assume cash-and-carry traders would use for balancing the market. This setting is present to ensure we leave sufficient liquidity for balancing positions.

Levana Well-funded Perpetuals - high level overview

This document provides a high level overview of the Levana Well-funded Perps (hereafter: perps or Levana perps) system. It is intended to be read by people already familiar with the general concept of perpetual swaps platforms, and will focus on the distinguishing characteristics.

You may want to first review the glossary.

- The problems we're solving

- The solutions

- Crypto denominated pairs

- Liquifunding

- Price updates

- Cranking

- Staleness

- Congestion

- Price triggers

- Liquidity pool

The problems we're solving

Levana Perps started from trying to solve a fundamental problem common in other perps platforms: the risk of illiquidity. In most perps platforms, traders going long are betting against traders going short. When the price moves upward, long positions take profits from short positions, and vice-versa. If longs and shorts remain balanced within the platform, then each side has sufficient liquidity to guarantee their profits.

However, as we have seen historically, this assumption of balanced markets is not always met. This is especially true in extreme market conditions, such as a market meltdown. In such a case, we may see far greater short positions than longs, and the protocol may be unable to honor profits for those positions due to insufficient liquidity.

Solving this problem drives the majority of the unique features within Levana perps. Keeping this risk in mind will help you understand why the protocol works the way it does.

A secondary issue we strive to address is market manipulation. In tradition vAMM/mark price perps platforms, position entry and exit prices are based on a mark price within the protocol. When there is low volume within the protocol, it becomes easier for traders to significantly move the mark price, allowing them to force-liquidate counter-traders and extract profits risk-free. Our design attempts to make Levana Perps a protocol that works for both a low volume perps protocol, and for smallcap coins, as well.

The solutions

There are two fundamental shifts in Levana perps versus traditional perps platforms

Locked liquidity

Instead of longs and shorts taking profits from each other and risking illiquidity, the protocol introduces the concept of liquidity providers (LPs). LPs provide assets that can be locked by traders against their positions. That locked liquidity represents the maximum gains a trader can achieve on a given position. Markets can be created in both stablecoin and crypto-denominated pairs. Crypto-denominated pairs have no capped gains for long positions. Stablecoin denominated pairs include capped gains to ensure all positions are fully collateralized at all times. Capped gains is a downside versus other perps platforms (but see crypto-denominated pairs for a mitigation), but ensures that all positions are, at all times, fully collateralized.

Additionally, the introduction of LPs into the protocol provides a relatively low-risk (though not risk-free) method for passive income.

Another advantage to having fully collateralized, well-funded positions is that it obviates the need for off-chain liquidation bots. Alternative perps platforms must make use of high availability, off-chain services to perform just-in-time liquidations in order to keep illiquidity to a minimum. In contrast, Levana perps is able to perform on-chain liquidations, thereby reducing its reliance on external services.

No mark price

Levana perps does not maintain an internal mark price concept. Instead, the spot market price is used for entry price and calculation of PnL within the system. This allows the protocol to remain stable even with little internal volume. It also avoids issues found with the more common vAMM approach to mark price perps, such as needing to choose an initial mark price and drifting further away from it as the spot price changes over time.

Funding payments are still used to encourage cash-and-carry arbitrage to balance out the protocol. However, instead of being based on a mark/spot price divergence, funding payments are now based on the net notional or total difference in long vs short position sizes.

Additionally, Levana perps introduces a concept called a delta neutrality fund to further incentivize a balanced protocol. Unlike funding payments, the delta neutrality fund takes lump-sum payments at position open, update, and close. Actions that push the protocol closer towards neutral receive a payment from the fund, and actions that push the protocol away from neutral pay into the fund.

Crypto denominated pairs

In addition to the problems described above, Levana perps attempts to address two additional issues:

- We would like to support chains that do not have easy access to reliable stablecoins. In such chains, a trading pair like ATOM/USD would generally be difficult for users to interact with due to lack of access to a USD-denominated coin.

- The limitation on capped max gains via stablecoins may limit use cases for some traders that would prefer to realize infinite gains on their positions, crypto-denominated pairs enables this.

To address both points, we introduce the concept of a “crypto denominated pair.” The underlying mechanism we use for such crypto denominated pairs is a "collateral-is-base" market, which is described further in our slides. By contrast, a stablecoin-denominated market would be called "collateral-is-quote."

In a “collateral-is-quote” perps market, the base asset (e.g. ATOM) is priced in terms of the quote asset (e.g. USDC), and traders deposit USDC to trade.

In a crypto-denominated pair, we flip this around. From a user perspective, we still talk about ATOM and USD as base and quote, respectively. However, the user deposits ATOM instead of USD. This addresses point 1: Levana perps can host a trading pair on a chain so long as either the base or quote assets are supported on that chain.

The second point requires a bit more of an explanation.

Infinite max gains

Suppose we have a stablecoin based market for ATOM/USDC. The trader wants to open up a long position on ATOM. The trader will:

- Establish an entry price, let’s say 10 USDC per ATOM

- Deposit some amount of collateral, let’s say 200 USDC, equivalent to 20 ATOM

- Set a max gains and lock some counter collateral from the liquidity pool. Let’s say this is 400 USDC. This establishes a max gains for the trader on this position of 200% (they deposited 200 USDC and could maximally walk away with 600 USDC, taking a 400 USDC profit).

Now, instead, let’s consider the situation where the trader is interacting on a market with ATOM as collateral, not USDC:

- Instead of depositing 200 USDC, the trader deposits 20 ATOM

- Similarly, instead of locking 400 USDC from the liquidity pool, the trader locks 40 ATOM

In such a case, the maximum collateral the trader can walk away with is 60 ATOM (20 deposit collateral + 40 counter collateral). This would appear initially to be the same as the 600 USDC described in the stablecoin market scenario.

However, PnL is not denoted in terms of ATOM. Instead, PnL is denoted in terms of the quote asset, or in this case USD. Since the trader opened a long position, the value of the collateral (ATOM) will continue to rise as long as the price rises.

In this case, the trader would like to tell the protocol to simply not provide a max gains price and allow a position to remain open regardless of how high the price goes. This would allow the trader to realize infinite profits in terms of USD. The protocol therefore allows a setting of “infinite max gains”, which skips the max gains price.

Note that this is only possible with long positions in markets where the base asset is used as collateral. When the quote asset is used as collateral, or for short positions, infinite gains are not possible.

Flipped leverage

The public interface of the system speaks about base and quote almost exclusively. Traders denote their leverage in terms of base (e.g. ATOM). Internally, the system works almost exclusively in terms of the notional and collateral assets. In essence, the system behaves as if the trader is depositing collateral to speculate on price movements of notional.

For traditional markets where base is notional and quote is collateral, this all lines up as expected. For example, with ATOM/USDC, the trader deposits USDC and opens a long position, hoping that the price of ATOM relative to USDC goes up. The system sees this as a long position with positive leverage.

However, in a crypto-denominated market like ATOM/USD, we turn all of this around. The collateral is now ATOM, and therefore the notional asset is USD. Internally, the protocol views everything as speculation of the price of USD in terms of ATOM. To understand how flipped this is, consider this table:

| Standard ATOM/USD | Inverse price USD/ATOM |

|---|---|

| $10/ATOM | 0.1 ATOM/USD |

| $16/ATOM | 0.0625 ATOM/USD |

| $8/ATOM | 0.125 ATOM/USD |

As the price of ATOM goes up, this is equivalent to the price of USD relative to ATOM going down, and vice-versa. Therefore, opening up a long position on ATOM is equivalent to opening up a short position on USD.

When receiving an order to open a position from a trader, the protocol accepts the leverage value in terms of the base and quote assets. It then converts that leverage number depending on whether collateral is base or quote. In a “standard” collateral-is-quote setup, the leverage is unchanged. In a “flipped” collateral-is-base setup, a long leverage is converted to short and vice-versa.

Complex side point: the simplest way to do this conversion is to simply negate the number: a 5x long position on ATOM becomes a 5x short position on USD. This turns out to introduce non-linear gains, because the trader is still exposed to price movements of ATOM by holding onto some ATOM as collateral. Instead, the formula we use is leverage-in-quote = 1 - leverage-in-base to account for that exposure. Therefore, if the trader opens a 5x long in a flipped market, internally this turns into a 4x short, or a leverage-in-notional of -4. This is discussed in more detail in our slides.

Liquifunding

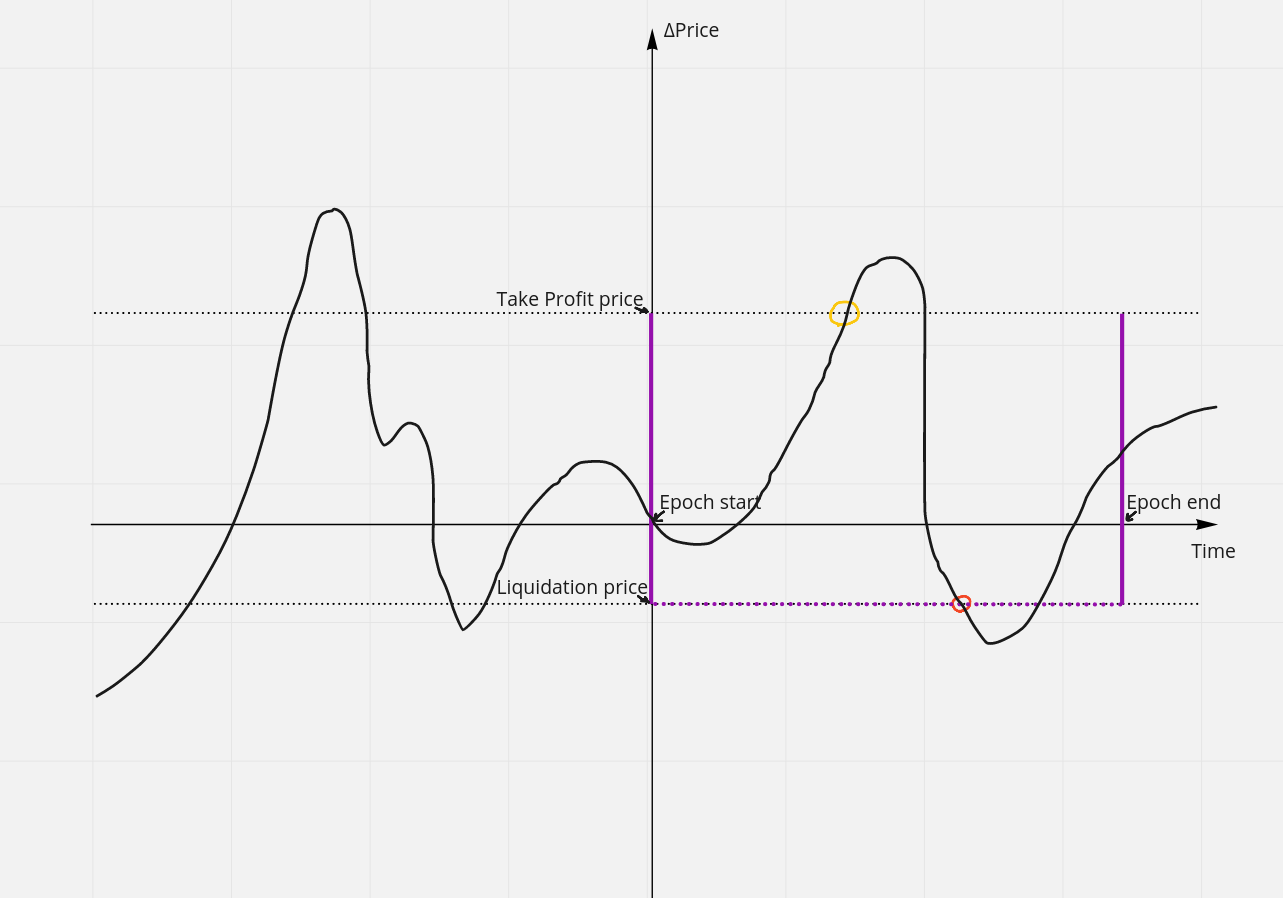

When a position is open, we calculate a number of parameters for the position. We first deduct the trading fees and any payments to or from the delta neutrality fund from deposit collateral. Then, we determine the maximum amount of fees the position may incur over the next period of time (the liquifunding delay plus staleness period) and set that aside as the liquidation margin. We then determine, based on the remaining active collateral, at what price point the position would become illiquid (the liquidation price) and when it would have achieved maximum gains (the max gains price). We set these values in liquidation data structures to be used by cranking. We also schedule a next liquifunding to occur after liquifunding_delay.

Later, the position will be liquifunded, either because of cranking or because the user attempts to update or close the position. At this point, the protocol needs to calculate how many fees and funding payments have been incurred since the last liquifunding and update active collateral. It also updates active collateral to reflect price exposure, meaning changes resulting from price movements. If the price moves in the direction of the position, active collateral goes up, otherwise it goes down.

NOTE Following on our well-funded concept: each position has locked counter collateral from the liquidity pool. When active collateral goes up due to price movement, the counter collateral goes down in the same amount, and vice-versa.

We then perform the liquidation margin calculation again. If there are insufficient funds for a liquidation margin, the position is closed. If max gains have been achieved, the position is closed. Otherwise, the new parameters are updated, new liquidation and max gains prices are set for cranking, and a new next liquifunding is scheduled.

NOTE: an interesting side-effect of the active collateral changing from liquifunding is that the leverage of a position will change over the course of its lifetime. The leverage will go down as the price moves in the direction of the position and funding payments are received. The leverage will go up as the price moves against the position and funding payments and borrow fees are paid.

Price updates

The protocol receives price updates via a permissioned entrypoint in the protocol. This entrypoint delivers the current price of the base asset in terms of the quote asset. The protocol stores this in a collection of previous price points and then performs a crank.

Note that the address approved to set the price can either be a wallet or a smart contract. Using a wallet essentially means that a trusted backend service will directly update oracle price into the market. By contrast, if the chain Levana perps is running on hosts a trusted third-party oracle, a smart contract solution can be deployed which will query the current price from the oracle and submit it to the perps contract. This allows the perps protocol to remain agnostic to where prices come from, and proactively perform tasks on a push-basis of prices being injected, rather than needing a pull-based model for querying for new prices.

In practice, production deployments of Levana perps currently all use the Pyth price oracle for price data, and a companion pyth_bridge contract acts as the permissioned price admin. This setup allows anyone to permissionlessly update the price in the Pyth oracle (using cryptographic proofs from the Pyth network) and then trigger the pyth_bridge to update the market with the new price.

Cranking

The crank process is responsible for running scheduled tasks and performing tasks (like closing liquidatable positions) based on price triggers. Cranking works by going through all price updates and performing operations for each price update point:

- Looks for any positions with a scheduled liquifunding in the past and performs the liquifunding process on it

- Looks for any positions with price triggers that are hit by the new price update. For example, if a long position has a liquidation price of $7 and a price update sets the price to $6, the position should be closed as liquidated.

After all actions are taken for the given price update, the crank sets the “last crank complete” to the timestamp of that price update and continues.

Once all liquifundings are completed and we have caught up to the latest price point, the protocol does not require any cranking. A query endpoint is available to check if crank work is available, and bots run regularly to perform cranking when work is available. In the future, we intend to provide incentivization for third parties to run crank bots.

Note that cranking is a permissionless process. It also involves some other corner-case maintenance activities on the protocol, like market wind-down "close all positions" and resetting LP balances on full liquidity withdrawal. However, these aren't core to the understanding of the system.

Staleness

The protocol relies on timeliness on two fronts:

- Price updates. If price updates are blocked to the system (such as by DDoS attacking an oracle), an attacker would be able to open a position based on knowing with certainty the current spot price and its discrepancy from the last price update in the system.

- Example: suppose the current price of ATOM is $10, and an attacker suspects the price will rise to $15. The attacker could simply open a long position, but that incurs risk that the price could actually go down. Instead, the attacker DDoS attacks the oracle, preventing any price updates into the system. The attacker can then observe the real movement of the spot price. If, as expected, the price moves to $15, the attacker can then open a long position (locked into the last price update of $10) and halt the DDoS attack on the oracles, allowing the protocol to see the new $15 price and realizing a large profit.

- Liquifunding. Liquifunding is the process that ensures that all open positions have sufficient liquidation margin to cover potentially incurred fees. If we go beyond the staleness period of a position, it may become insolvent, breaking our well fundedness goals.

To address both concerns, the protocol introduces the concept of staleness. If a price update has been delayed for too long a period, or if any position has reached the point where liquidation margin cannot be guaranteed, we become stale. When stale, the protocol will not allow positions to be opened, updated, or closed, or limit orders to be placed. To exit a stale period, price updates must come into the system and/or cranking be performed.

Under normal conditions, with a functioning blockchain, functioning oracle, and functioning crank bots, the protocol should never reach staleness. This is an extreme condition that indicates something has broken and the protocol needs to protect traders and liquidity providers.

Congestion

Congestion is similar in behavior to staleness, but derives from a different source. Consider this sequence of events:

- Price is updated in protocol to $8, and the crank is fully run.

- Price is updated to $9, but the crank does not fully run because of a large number of liquifundings.

- Price is updated again to $10, but the crank still hasn't finished processing the $9 price update.

- A trader opens a long position at the (correct) entry price of $10, and ends up with a liquidation price of $9.

- The crank finally moves past the liquifundings for the $9 price update in (2) and begins running price triggers (liquidations, take profit, etc.). It sees that the position opened in (4) should be liquidated at the price of $9 and closes it out.

This last step is a bug. The position had an entry price of $10, and that price landed after the $9 price we're currently cranking. We should not liquidate positions based on old prices.

To address this, we have the "pending price triggers" queue. If our crank ever falls behind on a price update, we place new positions' trigger prices on a queue and only add them to the price trigger tables after liquidations for that entry price have been fully processed. The downside of this queue is that the work items for opening and updating positions are doubled: we now need both a transaction to open/update the position, and another one to crank the position's price trigger to pop it from the "pending price triggers" queue and move it to the price trigger tables.

A potential attack vector would be forcing the protocol to fall behind on cranking (such as by DDoS attacking the crank bots) and then flood the system with open and update position messages, causing a large stream of work for the crank. An attacker could continuously update existing positions to keep putting them back onto the queue, causing the crank to never fully catch up.

To mitigate this, we introduce the concept of congestion. Once the pending queue reaches a certain size (by default, 500), we disallow opening or updating positions.

Like staleness, under normal circumstances this situation should never arise. However, by providing a congestion mechanism, we prevent any bug in the system or attack on the system from spiraling out of control.

Price triggers

The protocol automatically determines a liquidation and max gains price for a position at each liquifunding. Additionally, a user may set trigger prices for stop loss and take profit to avoid complete liquidation or to take profits early. These price triggers are observed by the crank mechanism, and positions are closed. Note that if a liquidation price hits before a stop loss, or a max gains hits before a take profit, the liquidation or max gains prices will be used.

Liquidity pool

A core feature of Levana perps is locked liquidity, which is provided by the liquidity pool. A liquidity provider can deposit collateral into the pool and receive LP tokens in exchange. These LP tokens can be burned to receive back collateral. If there is insufficient collateral available, the liquidity provider will need to try to withdraw liquidity later.

Instead of receiving LP tokens, liquidity providers can opt to receive xLP tokens. These xLP tokens cannot be immediately burned for collateral. Instead, xLP can be converted into LP tokens. This is a time-based conversion process that occurs linearly over 45 days. In other words, if you unstake 450 xLP tokens, after the first day you’ll have 10 LP tokens available, after the second day 20, and so on. Providers are rewarded with higher rates of return, and the protocol benefits by having more gradual liquidity withdrawals, making it less likely that there will be no available unlocked liquidity.

LP and xLP token holders receive pro-rata portions of the trade and borrow fees paid by traders. As mentioned above, xLP token holders will receive higher portions overall as an incentive.

The utilization ratio within the protocol is the percentage of collateral in the liquidity pool that is currently locked to a position. The higher the utilization rate, the higher the borrow fee will be. This provides a free-market incentive structure for setting the borrow fee naturally. If the borrow fee is too low, providers will not deposit collateral, leading to a higher utilization rate and higher fees. If the fee is too high, more providers will deposit collateral, leading to a lower utilization rate and lower fees.

The goal of the protocol is to protect providers from market movements. There are essentially two kinds of market movements that present a risk to liquidity providers:

Normal market movement

Under normal market movement conditions, the price moves in a “reasonable” timeframe up and down. The risk to liquidity providers is that, when a trader opens a position, the LPs are essentially forced to take an opposite side position. To make that concrete, consider a situation where everyone anticipates a 5% rise in the price of ATOM. Traders will flock to the system, opening large numbers of long positions, and liquidity will be locked as counter collateral. That counter collateral will be lost if the market goes up, essentially meaning LPs are taking a short position.

The problem here is that the longs far outweigh the shorts. If, instead, there was an equal amount of short and longs (i.e., the protocol’s net notional was balanced, a.k.a. we were delta neutral), LPs would face no risk: a positive price move would lose LPs money on the long positions, but would make back equivalent money on the short positions.

To protect LPs, the protocol has two mechanisms in place:

- Like most perps platforms, funding payments incentivize arbitrageurs to open cash-and-carry positions. If longs are more popular than shorts, an arbitrageur can open a short position in the perps platform, receive funding payments, and simultaneously open a long position in the spot market. The arbitrageur is now neutral on price movements, but receives a funding payment regardless. Similarly, assuming the presence of an external platform supporting shorts (e.g., a traditional options market), the arbitrageur can counter the protocol being overly short by opening long positions and opening short positions externally.

- The protocol introduces the concept of the delta neutrality fund. As the protocol veers further and further away from delta neutral, actions that exacerbate the imbalance will pay a fee into the fund, and actions that bring the protocol closer to neutral receive a payment from the fund. At the extreme, delta neutrality capping will prevent opening new positions or updating existing positions. (Closing positions is always allowed, even if it pushes the protocol further beyond the caps.)

- Note that, to prevent price manipulation attacks from being successful, we charge a tax (by default, 5% for most markets) on payments into the delta neutrality fund. This means that, even if an attacker could manipulate the spot price of an asset, each iteration of draining liquidity from the protocol would involve losing a portion of the profits to the delta neutrality fund. The 5% tax number increases the more susceptible an asset is to spot price manipulation (e.g., low spot volume coins will have a higher tax).

️️⚠️ Normal market risks

WARNING: Liquidity providers are subject to a real risk of impairment, where the value of their LP and xLP tokens in terms of the underlying collateral asset may go down over time. This will occur if the market is imbalanced and traders are successful overall. (By contrast, if the market is imbalanced and traders are unsuccessful in their trades, liquidity providers will benefit.) Liquidity providers can judge their exposure to this risk by observing the net notional, or the difference between long and short open interest. If there are more longs, liquidity providers will experience impairment if the price goes up, and if there are more shorts, they will experience impairment if the price goes down.

Delta neutrality ratio is another helpful parameter to look at. It reflects the price exposure risk of liquidity pool relative to its size. It is calculated at net notional divided by liquidity pool size. This will effectively express that as the size of the pool increases, the impact of a constant-size net notional imbalance will be reduced.

As the Levana Perps platform grows over time, cash-and-carry activity will yield higher rewards and net notional is expected to move closer to 0 (a neutral platform). During the bootstrapping phase of the protocol, there is expected to be more volitility and therefore more risk. The natural mechanism for addressing this is higher borrow fees from liquidity pool utilization that is higher than target utilization, which will reward providers for their assumed risk (and impairment losses) with higher APRs.

Extreme market movement

While normal market price movements are mostly addressed by the above mitigations, extreme market conditions are not. This is the primary risk undertaken by liquidity providers. Consider a case where the price of an asset collapses from $120 to $0.01. While that may seem extreme, one could imagine a scenario where that could happen.

In such a situation, we can assume that traders would stop opening long positions and would all try to open short positions. Pretty soon, delta neutrality caps would prevent further short positions from being opened, so we would be left with a market with some longs and lots of shorts. The longs would likely attempt to close their positions, which is allowed even in the presence of delta neutrality capping. We would now be left with a protocol almost 100% weighted towards shorts.

At this point, liquidity providers would likely be concerned for their investment and would attempt to burn their LP tokens, freeing their liquidity. Unfortunately, there will not be enough unlocked liquidity for all the providers trying to withdraw their liquidity. So we’ll be left with a significant portion of liquidity locked as collateral on short positions, essentially forced to take long positions that they cannot exit.

As the meltdown occurs, the short positions will begin to achieve max gains and capture the entirety of the counter collateral. In a crypto-denominated market, the risk asset itself is becoming worthless, but liquidity providers were prevented from selling the asset by the protocol. But in a stablecoin denominated market, the liquidity provider’s stablecoin is still valuable, and they have lost virtually all of it.

This is the risk liquidity providers need to be aware of when depositing in pools: in a market meltdown (or, equivalently, in a meltup) their deposited collateral can be almost entirely lost. Therefore, more volatile markets should demand a higher borrow fee to compensate for the increased risk assumed.

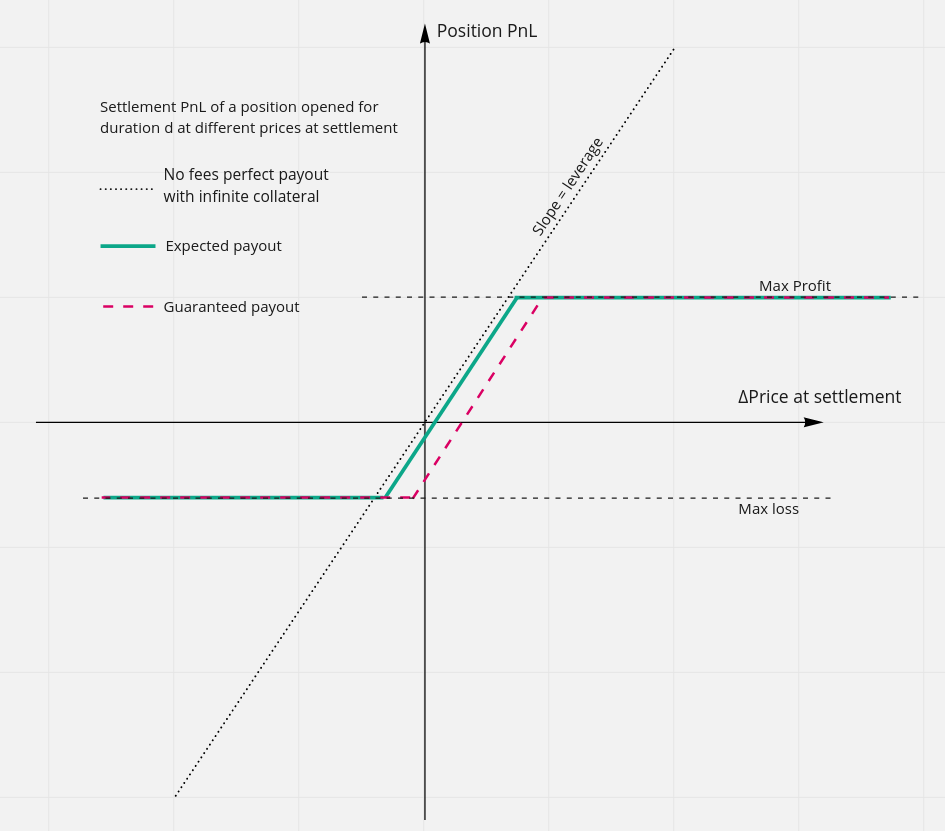

Position size versus locked collateral

One of the defining features of Levana Perps is locked collateral. This is the mechanism by which we ensure that each position's potential gains are well funded at all times. This can lead to some confusion about two similar but distinct topics: position size and max gains. We'll try to clarify that here.

NOTE: This document will intentionally use simplifying assumptions to make the math a bit easier, such as describing a collateral-is-quote market. If you try the same numbers in a collateral-is-base market—which includes any USD-denominated market—the numbers will be slightly different. But that shouldn't impact the intuition discussed here.

What is position size?

Position size represents how much exposure to price movement your position has. It is given by your deposit collateral times leverage. For example, if you deposit $500 in a long position and use 3x leverage, your exposure is equivalent to buying $1500 of the asset on the spot market. If the price goes up by 10%, you will make $150 in profit, not $50.

NOTE: This also explains why all leveraged positions have a liquidation price. In the above example, if the price went down by 50%, the position would have lost $750, which is more than the $500 the trader deposited initially. Therefore, we need a liquidation price that stops a position from losing more money than the deposit collateral. In this case, that would be a 33% price decrease. This also explains why the more heavily leveraged a position, the sooner you'll be liquidated if the price moves against you.

Position size is what determines open interest and net interest in the platform:

- Long open interest is the sum of the position sizes of all longs.

- Short open interest is the sum of the position sizes of all shorts.

- Total open interest is the sum of long and short open interest.

- Net open interest is the difference between long and short open interest.

What is locked collateral?

When you open a position, you specify a take profit price. Internally, the system converts this into a max gains, representing the maximum amount of profit you can ever take from this position. This occurs by borrowing liquidity from liquidity providers and locking it against your position.

Let's use the example above again. You have a long with a $1500 position size. The current price is $10. You set a take profit price of $12, or a 20% price increase. That means your max gains are $1500 * 20% == $300. The protocol needs to borrow those $300 from the liquidity pool and lock it into your position. This is the locked collateral, or equivalently the counter side collateral.

By constrast, if you reduce your take profit price from $12 to $11, the protocol only needs to lock collateral for $1500 * 10% == $150. Notice that the position size remains the same in both cases, but the locked collateral is significantly different.

As you can see in this example, the closer the take profit price is to the entry price, the smaller the locked liquidity. This is one of the reasons we recommend traders think carefully about the take profit prices they want. Not only is this a risk mitigation mechanism, but it is also a cost savings. Reducing your locked liquidity will reduce both your trading fees and your borrow fees.

Price risk to liquidity providers

Let's continue with the above example. A trader opens a long with the parameters:

| Parameter | Value |

|---|---|

| Deposit collateral | $500 |

| Leverage | 3x |

| Entry price | $10 |

| Take profit price | $12 |

The system will derive the following from these parameters:

| Derived parameter | Value |

|---|---|

| Trader position size | $1500 |

| Locked collateral | $300 |

Any gain the trader takes on the position will be withdrawn from the locked collateral, and vice-versa. Meaning, if the price moves up to $11:

- The trader has experienced a 10% increase via price exposure

- The trader will have profits of

$1500 * 10% == $150 - The liquidity pool will lose those $150 to the trader

- Caveat: as we discuss below, we strive to keep the protocol balanced, which will protect liquidity providers from these losses by ensuring for every loss on a long position, they will experience an equivalent gain on a short position, and vice versa.

Similarly, if the price decreases by 10% instead, the trader will lose $150 to the pool. This is equivalent to saying that, every time a trader opens a long, it's as if the liquidity providers have opened a short of the same position size. This leads to one more concept: counter-side leverage. In our example, the liquidity pool opened a $1500 short position using $300 of collateral. This means that the pool's counter-side leverage on this position is 5x, versus the trader's 3x leverage. From the liquidity pool's perspective:

| LP parameter | Value |

|---|---|

| Locked collateral | $300 |

| Counter side leverage | 5x |

| Position size | $1500 |

Why net open interest matters

The reason why net open interest is so important to the protocol is because it represents exposure to price risk for liquidity providers. If the protocol has too much long interest, for example, liquidity providers are being forced to open up more short positions than long positions. If the actual price goes up, liquidity providers will lose funds to traders through impairment. It's true that if the price moves down instead, liquidity providers will instead make money through impairment. But we strive to insulate providers from risk. Therefore, our goal is to keep longs and shorts balanced, also known as:

- 0 net notional

- Delta neutral

The mechanisms we use for this are incentives via funding rate payments and delta neutrality fees, which provide a profit motive for the implementation of cash-and-carry arbitrage, also known as basis trading.

Collateral lock-ups, risks and rewards

The inherent risk liquidity providers take on in this system is unbalanced price exposure. While—as just discussed—the protocol strives to minimize that risk, it cannot guarantee risk will be absent. And furthermore, in extreme market conditions (called a market meltdown or meltup), this risk is expected to be very high. In such a scenario, any liquidity in the pool is at risk of impairment, up to loss of 100% of their funds.

Liquidity providers can choose their level of risk, and receive commensurate rewards as a result. Therefore, there are two mechanisms for providing liquitity: LP tokens with no lock-up time, and xLP tokens with a 45 day lock-up window. LP tokens can be immediately withdrawn, provided that enough liquidity is in the system. xLP holders take on a higher degree of risk, and therefore receive higher rewards in terms of receiving a higher proportion of trade and borrow fees.

But to be clear, both groups are at risk of significant impairment. The protocol uses a dynamic borrow fee rate detection mechanism within the protocol to allow supply-and-demand forces to discover a fair market rate for this risk, a mechanism discussed in much more detail in our whitepaper. But the summary is: for assuming the risk of extreme market movements, LP and xLP holders are rewarded with high APRs on their deposits.

More details

This document attempts to focus on just the question of position size versus locked collateral. There is more information available in the rest of the doc site which may be relevant:

- High level technical overview

- The explainer slides give many more examples. The liquidity pools, trading overview, and collateral is base decks will be especially relevant.

Levana Well-funded Perpetuals Whitepaper

- Abstract

- 1. Motivation

- 2. High level protocol overview (TODO: better drawings)

- 3. Trading Mechanics

- 4. Incentivization structure

- 5. Liquidity Providers

- 6. Delta Neutrality Fee

- 7. Liquidations

- 8. State Staleness and Cranking

- 9. Crypto denominated markets and off-chain notional

- 9.1. Delta-neutral staking rewards arbitrage strategy

- 9.2. Long positions staking rewards propagation as negative funding rates

- 9.3. Stablecoin denominated pair with off-chain notional index

- 9.4. LP’s yield on crypto tokens in crypto denominated pairs

- 9.5. Settlement of crypto denominated pair trading position equivalence

- 10. Risks, rewards, guarantees and fee size

Abstract

Levana Well-funded Perps is a leveraged, well-funded and collateral-settled perpetual swaps protocol. It introduces a novel way to delineate risk between market participants. The incentive structure offers risk premium to the liquidity providers taking on the spot market illiquidity risk. Some of its key features are:

- Strong guarantees for settlement: Traders get strong guarantees for settlement in any future market conditions with a very low liquidation margin ratio. Liquidation price is solely based on spot price feed.

- Risk premium for liquidity providers: Liquidity Providers receive a risk premium for taking on spot market meltdown risk. This yield is found in a free market of supply and demand for liquidity to be used as collateral.

- No risk fund: Protocol doesn’t require a risk fund and the DAO Treasury has no insolvency risk.

The absence of native price discovery in spot-price settled perps is addressed by introducing a Capped Delta Neutrality Fee mechanism.

1. Motivation

1.1. Problems with constant-product virtual AMM model

A popular model for perpetual swaps is the constant-product virtual AMM (vAMM). This model introduces a virtual market against which users can trade. To ground it in reality and keep the virtual market’s price (known as the mark price) in line with the spot price, the protocol relies on a special payment referred to as a funding payment. This payment incentivizes traders to balance out long/short interest and keep the price stable.

This design was innovative and allowed for a perpetual swaps DEX to exist without an order book. However, it has critical flaws that prevent it from functioning long term in anything but a calm, low volatility market.

At the core of these flaws lies the fact that the vAMM model has unfunded liabilities. To pay out the profits to a particular trader, the vAMM model depends on two things:

- Liquidating other trader’s positions before they go into bad debt.

- Ensuring that certain positions remain open to keep the mark price close to the spot price.

This problem is usually solved with high liquidation margins, a reliance on off-chain liquidation bots, capital controls (such as disallowing withdrawals, closing and delisting markets, etc.), and heavy-handed dynamic fee incentives in the form of uncapped and sensitive funding rates. While these solutions work to mitigate some of the problems, they do not address the core issue, which is accentuated by the fact the protocol must still maintain an imbalance of open interest.

The magnitude of the imbalance is equal to the notional size of a position that would move the vAMM price from the price it was initiated at to the current spot price. This imbalance generally grows with time, especially in a market meltdown or melt-up. The initial vAMM price can be moved, but it is very costly to the protocol and doesn’t work in a meltdown scenario.

As the imbalance grows, so does the protocol’s unfunded liabilities. The protocol simply owes more to the popular side than it has locked in from the unpopular side. At this point, a race scenario is created whereby traders on the popular side are incentivized to close their positions quickly to ensure that they realize all of their profits. As the protocol is drained, it accrues bad debt and heads towards insolvency.

The vAMM model is brittle and has an open interest imbalance risk reminiscent of an algorithmic stablecoin depeg risk. Piling up additional incentives or market participants on a fundamentally flawed model does not inspire confidence. Because of that, Levana went back to the drawing board to design a leveraged perpetual swaps financial model that is well-funded as a core principle.

1.2. Benefits of Well-fundedness

A trader’s unrealized profit is a liability to the protocol. That liability is well-funded when the maximum profit is locked for specifically that position. By making all positions well-funded, the protocol gains the following benefits:

- Traders are guaranteed a fair settlement payout in any market conditions.

- Bad debt is impossible for a position by construction.

- Without bad debt, there is no risk of insolvency to the protocol as a whole.

- There is no rush to perform liquidations just-in-time before the position goes into bad debt.

The collateral that is locked as maximum profit comes from liquidity providers. Liquidity providers take on the risk of spot market meltdown. For taking on this risk, they receive a borrow fee with a risk premium.

The benefits of this mechanism are:

- This mechanism creates a decentralized supply-and-demand free market for liquidity with yield denominated in the collateral asset.

- The protocol does not have to rely on inflationary token emissions to attract liquidity.

- Different listed trading pairs are completely separated from each other with their own liquidity markets. This ensures that there is no contagion risk between different markets.

- Having completely independent markets makes deploying cross chain simple, as there is no risk fund or basket of notional assets that needs bridging.

- Well-fundedness guarantees to traders’ positions enable fearless composability of other financial protocols on top of tokenized positions.

2. High level protocol overview (TODO: better drawings)

Levana Well-funded Perps is a platform for leveraged perpetual trades. It has multiple completely separate listed markets, each of which is a trading pair of a notional index and a collateral crypto asset.

A trader that wishes to enter a position provides collateral and gains leveraged exposure to the notional index price. All traders are guaranteed to be able to close their positions, settling with the oracle spot price. The oracle spot price is the current exchange ratio between the notional index and collateral asset.

Markets are generally separated into two categories: stablecoin denominated and crypto denominated:

- A crypto denominated market has US dollars as the notional asset and a volatile native or bridged asset as the collateral asset in which every trade is opened and settled. Crypto denominated markets are well-suited for native to chain crypto assets and bridged assets with deep liquidity. Trading pairs with native crypto collateral assets do not have stablecoin depeg, centralization or bridge hack risks, and create sought-after crypto-asset lending with fair risk-premiums.

- A stablecoin denominated market has a stablecoin set as its collateral asset and any notional index. Stablecoin denominated pairs are well-suited for small-cap crypto assets that are not bridged to the platform’s chain and off-chain assets. These trading pairs make it possible to list any exotic, non-crypto, or synthetic asset and create delta-neutral stablecoin lending with fair risk-premiums.

2.1. Trader’s position

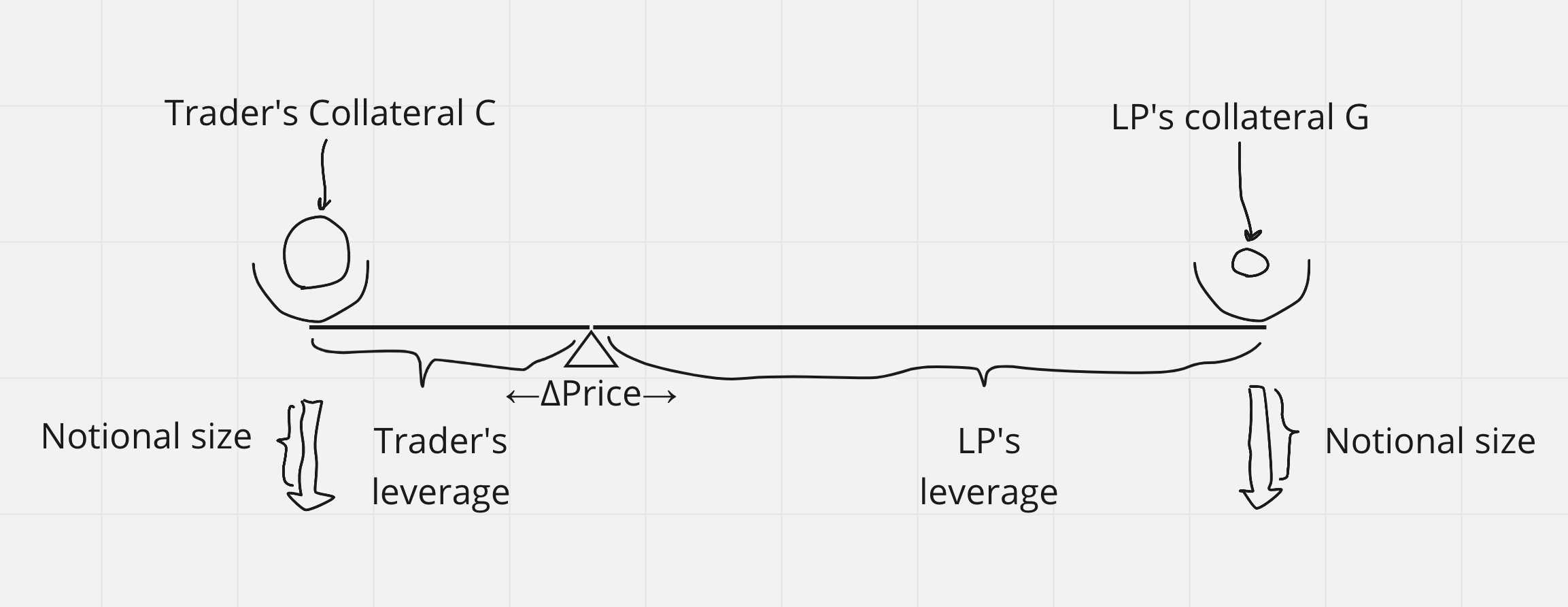

Figure 1. Leveraged position on Levana Well-funded Perps. TODO: notional size arrows should be reverse of each other. Add fee arrow directions.

Traders open positions by providing collateral and choosing position parameters. In a crypto denominated pair, the traded crypto asset itself acts as collateral, while in the stablecoin denominated pair, that stablecoin acts as collateral.

Position parameters are:

- Leverage of the trade. Leverage and provided collateral (with entry price) define the notional size.

- Max gains that this position can realize. This defines the amount of collateral that will be locked on the counter-position of the trader’s position. Long positions in a crypto denominated trading pair have an option of infinite max gains.

💎 Internally, Levana Perps uses max gains to define how much counter collateral to lock against a position. However, the web frontend does not expose this concept. Instead, it exposes the more familiar concept of a take profit price. The frontend is responsible for calculating the amount of max gains necessary to ensure the specified take profit price.

The collateral that the trader provides defines the max loss to the trader. The collateral that the protocol locks in the counter-position defines the max profit to the trader.

In a crypto denominated pair, long positions may have unlimited max profit if the locked collateral for the counter-position is equal in size to the whole notional size of the position.

Max loss of a position is realized when the oracle price feed crosses a liquidation price threshold. Similarly, max profit is realized when the oracle price feed crosses a take profit price, if present.

Traders may close their position at any point in time, settling the payouts to themselves and Liquidity Providers at the current spot price.

💎 All positions in Levana Perps are well-funded. Well-fundedness is a guarantee to settle at any time, at any spot price, and in any market conditions.

A trader may be unable to open a new position that would use more collateral on the counter-side than the liquidity remaining in the pool of available capital. This is expected to happen only in extreme market conditions.

2.2. Liquidity Providers’ pool of capital and yield

Liquidity Providers deposit their funds into a single pool of capital denominated in the collateral asset of the trading pair. This pool is specifically for that trading pair, and funds from it are used to enter into a net total counter-position to all traders’ positions for that trading pair.

To make the liquidity pool roughly delta-neutral with respect to the notional index, the protocol charges a per-block funding rate fee from owners of popular-side positions and pays this to owners of unpopular-side positions. The payment is scaled with signed notional size of the position.

To compensate Liquidity Providers for the cost of their capital and a premium on the risk that they take on, the protocol charges a per-block borrow fee from all traders and pays it to Liquidity Providers as yield on provided principal.

🔥 Liquidity Providers take on the risk of the meltdown (or melt-up) of the assets, but not a bear (or bull) market. The difference between meltdown and a bear market of the same magnitude is the existence of cash-and-carry traders comfortable enough to perform arbitrage to earn funding rate payments, bringing the LP pool into rough delta-neutrality.

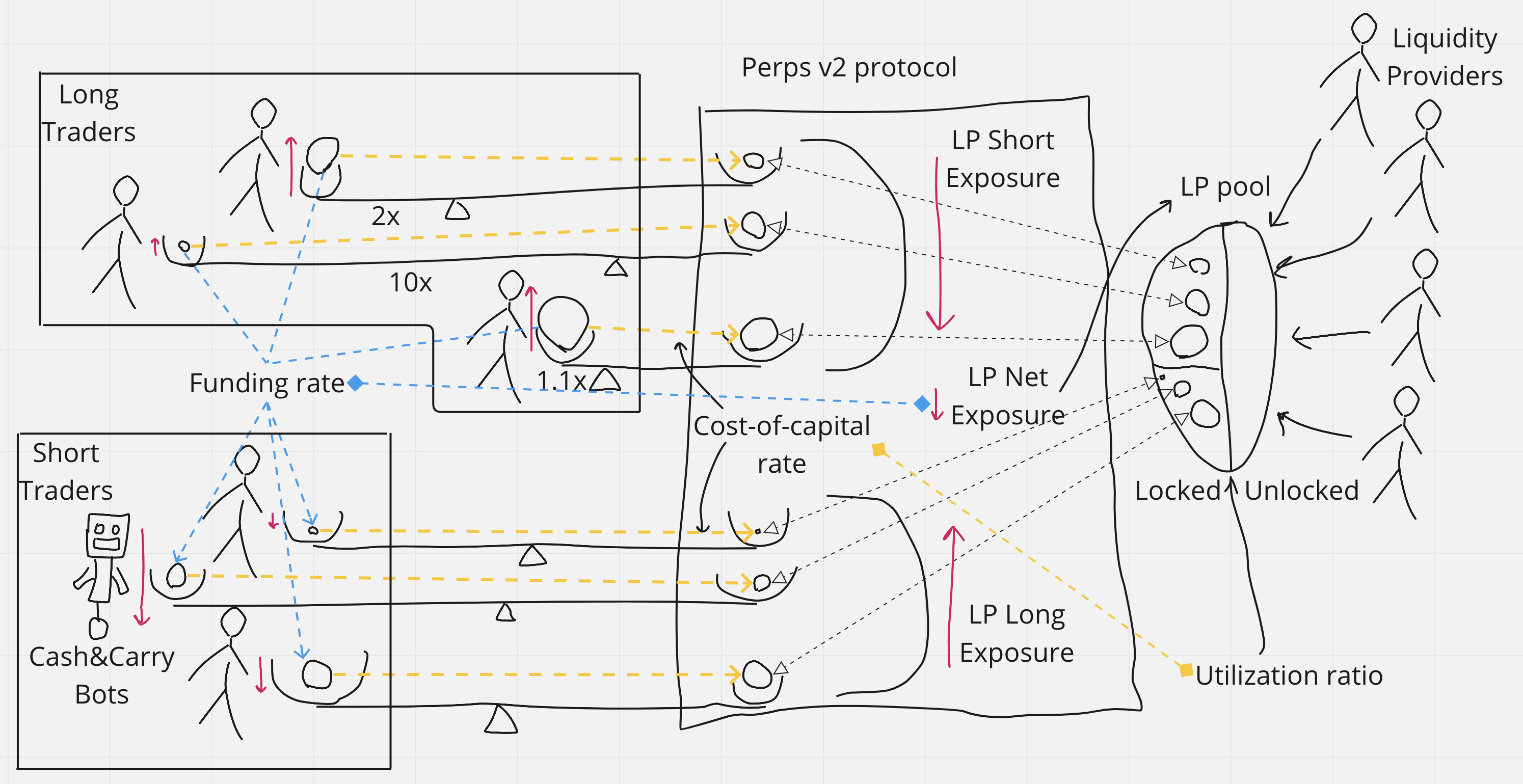

2.3. Protocol Market Participants and Incentives schema

Figure 2. Market participants and protocol balancing on Levana Well-funded Perps. TODO: Borrow fee yellow lines should go into a separate yield fund, not collateral on the counter-side. Add delta neutrality fund to the schema?

Funding payments are paid from positions with popular directional exposure to the unpopular ones. The funding rate is scaled with net notional open interest. The funding payment for a particular position is scaled with notional size of that position.

Cash-and-carry bots come to earn funding payments. To do that, they open unpopular positions on Levana Well-funded Perps, and also open counter-positions on the spot market to become delta-neutral.

For crypto denominated pairs with collateral assets that have high staking rewards, there is also a unique delta-neutral strategy available on Levana Perps that allows traders to earn staking rewards without exposure to the underlying asset. This possibility exists because it is possible to open a short position that pays a borrow fee on a fraction of the notional size of the position.

Liquidity Providers pool their capital into a single liquidity fund per market. This pool of funds is used to lock collateral on the counter-sides of all traders’ positions. The fund has a utilization ratio of locked funds to all funds in the pool. Borrow fee payments are payed for locked collateral on the counter-side and appear as yield for Liquidity Providers. A part of the yield stream goes to the protocol treasury.

2.4. Protocol dynamics listing a high staking rewards token

The unique feature of Levana Perps is that traders pay a borrow fee on counter-side collateral, which can be multiple times lower than the notional size of the position. This gives traders the ability to hedge high staking reward tokens cheaply, making it viable to earn delta-neutral yield from staking.

Because the delta-neutral strategy opens short positions on Levana Perps, funding rates will persistently pay long position holders to hedge the shorts. Funding rates would become a cut-down version of staking rewards, paid on leveraging up the notional size of long positions. This allows token bulls to both be able to enter a long leveraged position and still receive at least a portion of the staking rewards without having to decide on one or the other.

Liquidity Provider’s yield is found in the supply and demand dynamics, and would most likely end up being the risk-free staking rewards yield, plus the risk premium perceived by LPs.

All three types of actors: delta-neutral arbitragers, token bulls, and LPs - have unique and attractive use cases in Levana Perps, which enable each other.

3. Trading Mechanics

3.1. Opening a new position

On opening a new position, the trader provides the position parameters and sends funds with trading fees. If the conditions to open a new position are met, the position is opened and a guarantee is made to the trader.

3.1.1. Open message parameters

Open message for a new position \(pos\) with oracle price of a particular trading pair contains three parameters:

- — notional size of the position. This parameter does not change until the position closes or the trader explicitly updates . is positive if trader’s side of the position is long and negative if it is short.

- — Collateral on trader’s side of the position .

- — Collateral on counter-side of position . Also known as max profit on position .

The position is opened with oracle price feed:

- — exchange price of notional index to collateral asset at ’s open transaction timestamp.

3.1.2. Funds and trading fees on opening a position

During the execution of the open message, funds and fees are transferred:

- amount of collateral from a trader’s deposit account is locked.

- amount of collateral from unlocked pool of LP capital is sent and locked in a locked pool of LP capital .

- An NFT token representing trader’s side of the position is minted and sent to the trader.

- A trading fee (default ) of notional size denominated in collateral is sent into Yield Fund.

- A trading fee (default ) of counter-side collateral is sent into Yield Fund.

- A delta neutrality fee is paid to or received from the delta neutrality fund . See Section 6 for more details.

3.1.3. Conditions for opening a new position

To successfully open a position, these conditions should be met:

-

Leverages on traders side and on counter-side should not exceed maximum allowed leverage (default 30x) of the trading pair.

-

Open message fails if the delta neutrality cap is reached and opening a position would have pushed open interest into further imbalance.

-

Open message fails if it is not possible to bring open interest back into balance without either closing existing positions or having more liquidity provided. More precisely, message fails if the rest of unlocked LP capital leveraged up at is not enough to balance net open interest imbalance :

-

If utilization ratio hits close to 100%, traders may be unable to open new positions.

-

There must be sufficient unlocked liquidity in the protocol that a balancing position can still be opened after this action which would bring net notional to 0. We use the carry leverage parameter for this, which indicates the minimum counter leverage value necessary on a balancing position.

All market participants take on the risk of bugs and hacks of the protocol infrastructure:

- A bug in the implementation of the protocol.

- A hack of bridge of the collateral asset if it is a bridged asset.

- Oracle hack or downtime.

- Blockchain downtime removing the ability to execute message closing the position.

Now, let us dive into quantitative estimations of all these risks and rewards.

3.2. Settling an existing position

The trader may choose to close his existing position and settle at the current oracle price. There are no conditions that need to be met to settle the position, and the payout is always fair because the position is well-funded.

Let us consider the case where the position have not crossed liquidation price or take profit price. The case of settling the liquidated position is explained in Section 7.

Payout to the trader on settlement will be equal to:

Where:

- — price difference between price at the moment of settling and at the moment of open.

- — payout to LPs, will be sent to .

- — payout from (or to, if is negative) the delta neutrality fund on settling trade.

- — funding payment that was lazily accumulated, but was not yet actualized.

- — borrow fee payment that was lazily accumulated, but was not yet actualized.

More about fees and in Section 4. More about capped delta neutrality in Section 6.

The total amount of funds associated with the position and sent as payouts at settlement is:

Form that we can calculate LPs’ payout:

LP payout is not affected by funding payments or delta neutrality fee paid by the trader. Borrow fee payments are sent into a separate fund from which LPs are free to withdraw their share.

3.3. Updating Position

All three of the position main parameters , and can be updated after opening the position. The process is functionally equivalent to settling and immediately reopening a position with the new parameters. The only difference of update to that two-step process is trading fees. Trading fees are charged on the difference of new and old and .

This means that the protocol does not charge any trading fees at all to top up or withdraw collateral on the trader’s side. The fees on topping up to increase Take Profit price or slightly changing to target a desired leverage are efficient for the trader.

3.4. Tokenized positions

On opening position , the trader receives an NFT token representing the position . The owner of the token can update or settle the position. The original owner is free to sell their position on the secondary position market.

3.5. Peer-to-peer position

The positions on the protocol are symmetrical in terms of price movement and collateral. The asymmetrical parts are fees and the fact that only traders have the right to settle a position.

The symmetrical nature of the underlying financial instrument, well-fundedness of a position, and the tokenization of the position allow the position to be decoupled into a natively-leveraged peer-to-peer futures contract represented as a pair of interlinked NFTs. One NFT represents long side of the trade, and the other NFT represents the short side of the trade.

More information can be found in Section 10.

4. Incentivization structure

Protocol incentives are structured in such a way that:

- Traders are able to open new positions.

- The pool of funds from Liquidity Providers removes most risks, except for spot market illiquidity risk.

To meet these requirements, Levana Well-funded Perps has two capped dynamic fee mechanisms.

4.1. Fee rate cap

Traders’ existing positions do not depend on the protocol staying in balance. The only way that an unbalanced protocol state affects existing positions is through dynamic fees.

The protocol has reasonable caps on dynamic fee rates. This allows the protocol to uphold the spirit of the well-fundedness guarantee. Without a fee cap, in a market meltdown scenario, the fees may skyrocket, liquidating positions that should have been in major profit instead.

The protocol can afford to cap the fees because all positions are well-funded. Even if the protocol does not charge any fees, max loss and max gains are locked, so any price at settlement is funded.

4.2. Protocol Balance

Levana Well-funded Perps has two ways it can become unbalanced.

4.2.1. Long and short notional open interest imbalance

Net notional open interest is the total net exposure to the notional index of all opened positions. Liquidity Providers’ exposure to the notional asset is exactly opposite: . The protocol tries to maintain rough delta-neutrality for liquidity providers, so it tries to balance around .

The mechanism for balancing is a variation on a familiar concept: a funding fee payment from popular-direction positions to unpopular ones.

4.2.2. Balancing utilization ratio of Liquidity Providers’ pool of capital

Utilization ratio of LPs’ pool of capital is the ratio between capital that is locked as collateral in the counter-positions to traders and all the funds in LPs’ pool of capital.

The protocol has a target utilization ratio . If current utilization ratio deviates from , the LP pool becomes unbalanced. is chosen to be as close to as possible, but not so high that it would cause problems. A dynamic way to find appropriate is explained in Section 5.

- If is significantly lower than , then the capital efficiency of the provided liquidity is low. Only the locked part of the provided liquidity actually earns a borrow fee, but the yield is spread over all liquidity, locked and unlocked.

- If the utilization ratio is high and closing on , then traders are unable to open new positions and liquidity providers are unable to withdraw their funds because there are no unlocked funds available.

The mechanism to entice LPs to provide collateral is borrow fee payments that always flow from the direction of traders to LPs. The borrow fee rate is gradually updated such that the utilization ratio would stay at .

4.3. Fee payment

Fee payment is accounted for with nanosecond precision and retroactively calculated at the moment of payment. Each position makes fee payments regularly at its own cadence, or when it is updated or closed. This ensures that each position pays the fees exactly for every block that it was opened for.

The position liquidation margin includes just enough funds to cover one fund period's worth of funding payments for the position. This is necessary to ensure that positions on the unpopular side will receive all of the funding payments that they are due under any market conditions.

4.4. Funding rates and payments

Funding payments are done exclusively between positions. This means that the total amount charged as a funding payment from a popular position is the total amount received by the corresponding unpopular positions.

Usually, perpetual protocols have the same funding rate for popular and unpopular sides. This means that the total amount charged is always higher than amount sent as funding payments and the protocol pockets the difference.

As Levana Well-funded Perps is well-funded and does not have to cover bad debts, there is no need to pocket the difference. This means that the actual funding rates on the platform can be smaller.

Equality in total amounts of funding payments means that there will be two funding rates: one for longs and one for shorts.

4.4.1. Funding rates

Funding rates change only when positions notional sizes change, which means the protocol is able to update the funding rates data series and have all the per-block lazily calculated information about funding rates.

The popular side funding rate and effective funding rate sensitivity are defined per block as:

Now depending on which side is more popular the long funding rate and short funding rate are defined as

- Equal amount of longs and shorts ( is 0):

- = 0 or = 0 :

- Longs are more popular ( is positive):

- Shorts are more popular ( is negative):

Where:

- — total long open interest.

- — total short open interest.

- — total interest volume.

- — funding rate sensitivity parameter of the trading pair.

- — delta neutrality fee sensitivity parameter of the trading pair.

- — delta neutrality cap parameter of the trading pair.

- — maximum funding rate parameter of the trading pair, usually 90%.

4.4.2. Funding payment

With funding rates known for any block, it is possible to lazily calculate average funding rate over a specified time period .

With that, the funding payment is:

The payment amount has an upper bound:

Where:

- is either the take profit or liquidation price level, depending on whether is long or short.

4.5. Borrow fee rate and payments

The borrow fee is based on the supply and demand of the protocol’s liquidity. And the decision as to when users will provide liquidity to the pool, is made based on several factors. Liquidity providers provide liquidity to the pool if the borrow fee rate is high enough to cover risk-free potential yield and premiums for all of the perceived risks.

The borrow fee carries three functions:

- Risk-free potential yield passed up.

- Risk premium on notional or collateral asset meltdown/melt-up.

- Compensation for delta neutrality index having a small, but persistent bias.

All three functions can be covered by one mechanism that determines the borrow fee rate.

4.5.1. Borrow fee rate

Just as funding rates change per block, borrow fee rates also change per block, but gradually. The change in the borrow fee rate from the previous block to a new one is proportional to the difference between the target utilization ratio and the actual utilization rate in that block. More details can be found in Section 5.

4.5.2. Borrow fee payment

With a borrow fee rate known for the liquifunding period, the funding payment for a time period inside the liquifunding period can be calculated. Let's first consider the uncapped version of the borrow fee payment:

Where:

- — length of period of time in question.

- — average borrow fee rate over period .

- — average value of price multiplied by the borrow fee rate in that block over period .

Borrow fee payment has an upper bound, because is bound by :

5. Liquidity Providers

Liquidity Providers can provide collateral asset into an LP pool of a particular trading pair. For providing liquidity, the LP tokens are minted and signify a share of the pool.

Borrow fee payments are credited pro-rata to owners of LP tokens and stored in a separate Yield Fund alongside the trading fees. LPs are free to withdraw their per-block accumulated share of the yield fund. A fixed percentage of the Yield Fund is credited to the DAO Treasury.

Withdrawing from the liquidity pool is only possible if there is collateral left that is not locked into any counter-position.

5.1. Supply and demand for liquidity

Liquidity Providers offer liquidity to the system in the form of collateral ready to be locked into counter-positions. Traders create demand for that liquidity by locking counter-position collateral and not closing their old positions. The borrow fee rate is the price signal in that supply and demand dynamics.

If the borrow fee rate increases, it means that LPs earn a higher yield and traders pay higher fees. In this case, the supply of liquidity increases because LPs are attracted to earn higher yield, and the demand from traders decreases. The reverse is also true: if the borrow fee rate decreases, the supply decreases and the demand increases.

A gradual automatic borrow fee rate update mechanism allows the free market of liquidity to find an appropriate price for that liquidity.

5.2. Liquidity Provider pool utilization ratio

Liquidity Providers’ pool of capital has two parts: funds locked as collateral in counter-positions to all opened positions, and unlocked funds . Only actually collects a borrow fee from traders. This means that LPs’ pool at any time has the utilization ratio:

To target a specific utilization ratio, the borrow rate can be gradually changed. The target utilization ratio should be close to to make the LPs’ pool capital efficient, but not quite at so that there is plenty of collateral to allow new positions to be opened or some LPs withdrawing funds. A healthy utilization ratio is somewhere in the range of 75% to 90%, depending on the exact trading pair.

5.3. LP and xLP tokens

In addition to holding LP tokens, Liquidity Providers have an optional ability to time lock part of their LP tokens and mint xLP tokens. Minting xLP by burning LP tokens is immediate, but the reverse operation of time unlock happens gradually and linearly over a set and long period of time, such as 45 days, chosen per trading pair.

To incentivize time locking of LP into xLP, xLP tokens receive a higher proportion of fees than LP tokens. This is called the xLP rewards multiplier. Each market contains a configuration for a minimum and maximum xLP rewards multiplier (by default, 1 and 2, respectively). The actual value is chosen by interpolating between the low and high value based on the proportion of collateral deposited into LP vs xLP. For example:

- If all collateral is in xLP, no additional incentivization is needed, and the minimum multiplier is used.

- If all collateral is in LP, we need to maximize the incentivization, and the maximum multiplier is used.

- If the collateral is split 50/50 between LP and xLP, the midpoint between minimum and maximum is used.

Time lock on xLP with gradual and linear unlock into LP tokens allows to also change gradually and continuously. This, in turn, allows for gradual and continuous updating of the borrow fee rate.

5.4. Withdrawing Liquidity

Withdrawing liquidity associated with xLP tokens is made to be a long process by design. This leaves liquidity associated with LP tokens with more opportunity to withdraw in a market meltdown. But even so, of funds are targeted to be locked. In a market meltdown scenario, there may be an on-chain first-come first-serve race to withdraw unlocked funds. As the meltdown continues, we expect that:

- Traders will continue to drain liquidity from the pool.

- New traders will continue to enter the market, absorbing any unlocked liquidity available, essentially creating a liquidity race between traders and liquidity providers.

- Due to the fast nature of a meltdown, and the fact that we cap borrow fees, borrow fees paid to liquidity providers will be negligible compared to impairment losses.

- The utilization ratio will remain close to 100%, regardless of target utilization ratio, until all liquidity is drained.

This is the primary risk associated with being a liquidity provider. xLP holders absorb a higher portion of this risk because they have no ability to quickly exit their positions, even if unlocked liquidity is available.

One mitigation for this is providing secondary marketplaces for trading LP and xLP tokens directly. This also provides an automatic risk measurement indicating the perceived likelihood of a market meltdown playing out.

5.5. Borrow fee rate updating mechanism

With target utilization ratio and actual utilization ratio known at a per-block basis, it is possible to compute the average bias of the actual utilization ratio from target utilization ratio over the previous liquifunding period.

The borrow fee rate for the new block can be calculated as follows:

Where:

- — a meta-parameter, sensitivity of the borrow fee rate to utilization ratio bias.

A PID-controller choosing a new value based on signal may be appropriate to fine-tune and the differential and integral parameters.

6. Delta Neutrality Fee

Spot-price perpetual protocols without delta neutrality fee have no native price discovery mechanism. The model depends on arbitrage with the spot market to propagate the price response through the spot price oracle.

If the perpetual swaps volume starts to approach the volume on the spot market, big trades on the protocol without a delta neutrality fee would benefit traders at the expense of liquidity providers by creating small-scale flash meltdowns and meltups.

Spot market manipulation also starts to become more profitable. If an attacker is able to manipulate the spot market price short-term by a significantly higher margin than trading fees on the protocol, they are able to guarantee a profit from the protocol, ultimately draining liquidity providers.

To alleviate all of these problems, a delta neutrality fee (DNF) mechanism is introduced.

The cap on the delta neutrality fee rate is required to uphold the spirit of well-fundedness. If the protocol balance could make the delta neutrality fee arbitrarily large, the guarantee to traders to settle at any time and price would be compromised.

The DNF’s primary purpose is to defend liquidity providers. And, because DNF lowers risk to LPs, it lowers borrow fees. This is an additional benefit to traders, making a protocol with a DNF mechanism more attractive to both traders and LPs.

6.1. Delta neutrality fee construction

The delta neutrality fee is a percentage difference between the trade price and spot price, and it is directly proportional to the short-long open interest imbalance.

6.1.1. Instant delta neutrality fee

Instant delta neutrality fee at current net open interest is defined as:

Where:

- — clamped into the range .

- — sensitivity parameter of the trading pair.

- — cap parameter of the trading pair. A good default value is .

The sensitivity is chosen depending on the estimation of the price elasticity of the spot market, not the protocol itself. If the DNF on the protocol is at least times more elastic than on the spot market, the price signal can travel into the spot market. This means that, for markets with very deep liquidity (e.g., the bitcoin market), the DNF can in practice be made extremely small.

Because the price is chosen to be more elastic on the Levana Well-funded Perps market than on the spot market, traders who want to enter huge positions are incentivized by high DNF costs to split them into multiple positions, giving time for arbitrage to occur in between these sub-trades.

can be estimated by answering the question: How much new spot long interest is needed to double the price?

6.1.2. Delta neutrality fee of a trade